What do you like the most about your home - the bright, sun-filled kitchen, the shiny wood floors or the comfortable bedrooms?

Or is it the fact that your home probably makes up maybe the biggest part - of your total net worth?

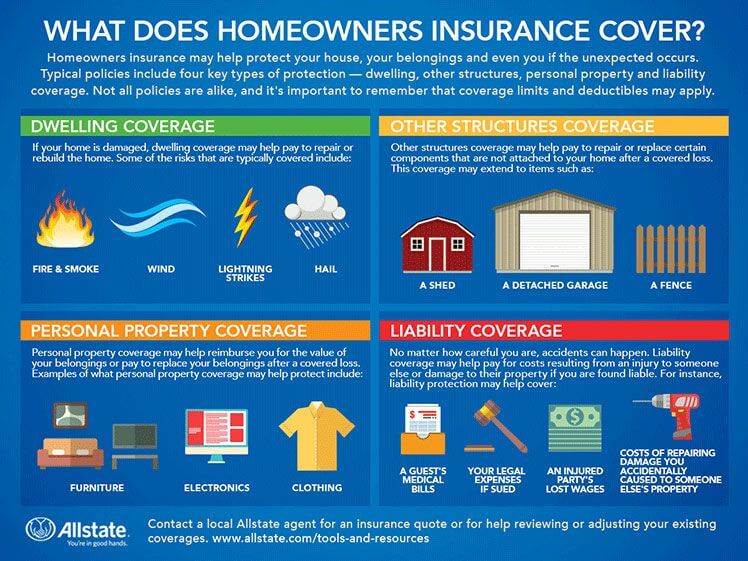

Either way, you have to protect what you have, using homeowner's insurance.

Although there were reports a few years ago of higher prices and limited availability for homeowners insurance, the market has opened up again, according to J. Robert Hunter, insurance director for the Consumer Federation of America. Premiums are expected to rise by no more than the inflation rate this year, he said.

"The market remains a competitive one where homeowners' insurance shoppers can be selective," said Marshall McKnight, a spokesman for the state Department of Banking and Insurance.

Here are several ways to save on home insurance:

Shop around. While many homeowners believe that all insurance companies charge the same, that's an expensive mistake. Use a service such as ours to compare rate quotes from different companies if YOUR area. To get started, just use the form on the right.

"You can go from one company to another and pay twice as much," said Hunter.

And don't just call an agent and expect him to do the shopping for you, Hunter advised, because agents don't represent all companies and might not get you the best deal.

Insure for "replacement cost" rather than "actual cash value." After all, if your belongings are destroyed, do you want the insurance company to send you enough to buy a new couch - or do you want a $50 check for the actual value of your 11-year-old couch?

Make sure you are covered for at least 80 percent of the cost of replacing your home. If you're not, it could hurt you even if your home does not need to be completely replaced.

Let's say your home would cost $200,000 to replace and you're insured for only $100,000, half of the replacement cost. If you have a $10,000 loss, you would get only half of that amount, or $5,000.

Of course, knowing how much it would cost to replace your home is not always easy. For example, I know how much I paid for my home, and how much I could probably sell it for, but I don't have a clue how much it would cost to rebuild if it burned down.

The state Department of Banking and Insurance and the Insurance Council of New Jersey recommend that homeowners in this situation should consult their insurer, who will be able to estimate the cost of rebuilding based on the size and location of the home.

Think twice before calling your insurance company with small claims for minor home damage. There have been reports of homeowners facing much higher premiums after putting in only two claims. So if it's a loss you can handle, take care of it yourself.

And, in that vein, consider a higher deductible.

"If you're not going to file a small claim, it's no use paying a premium to be covered for an amount you wouldn't file for," Hunter said.

"Every dollar you give to an insurance company, on average you only get back 60 cents," Hunter said. The rest goes to the insurance company's profit and overhead. So if you can self-insure for smaller losses, you should.

About 20 years ago, Hunter raised |the deductibles on both his car and |home policies, and banked the money he saved on premiums in a special account. Over the years, he used that account to pay for about $2,000 to $3,000 in losses, mostly auto-related. He still has $4,000 - money that the insurance company |could have had.

"Nowadays, most insurance companies recommend a deductible of at least $500. If you can afford to raise your deductible to $1,000, you may save as much as 25 percent," according to the Insurance Information Institute, an industry group.

Make sure your home insurance policy includes enough liability insurance, in case someone is injured on your property.

Consider buying your home and auto insurance policies from the same insurer. Some companies will take 5 to 15 percent off your premium if you buy two or more policies from them.

You can get discounts if you install smoke detectors, deadbolt locks or burglar alarms.

Keep your credit history clean. Insurance companies are increasingly checking credit reports to set their rates.

Komentar

Posting Komentar